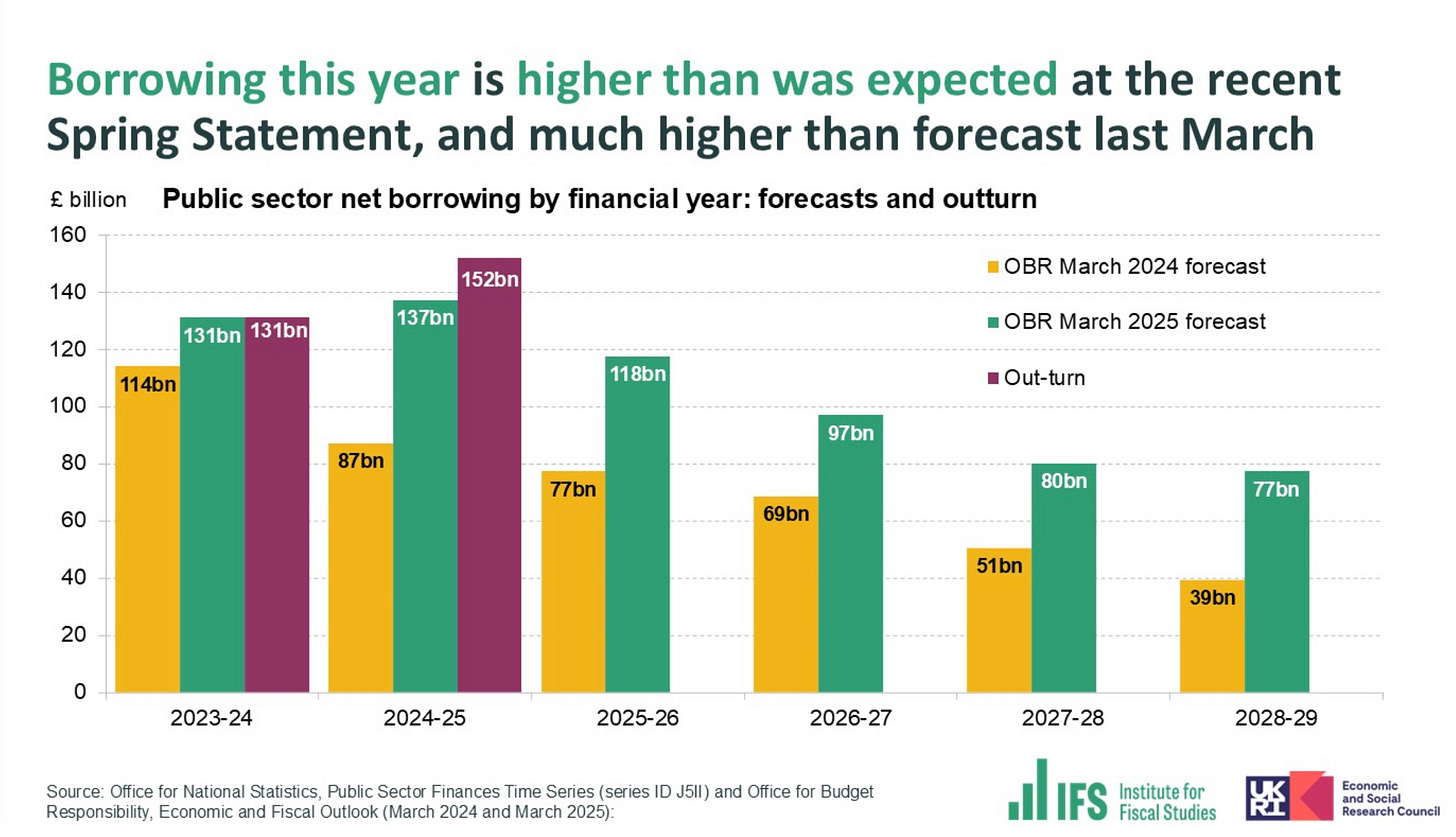

UK government debt is soaring. Annual public borrowing - the shortfall between tax revenues and government spending – was £152 billion during the year to March. That’s 10pc more than the £137 billion forecast published just a month ago by the Office for Budget Responsibility, the official fiscal watchdog.

So borrowing over the fiscal year that has just ended was £15 billion higher than forecast only last month - at the time of the Spring Statement. The 2024/25 borrowing total was an incredible £65 billion greater than the OBR’s forecast of £87 billion back in March 2024 – an overshoot of no less than 75pc.

Central government current spending topped £1 trillion last year, up by nearly £50 billion, an increase attributable in large part to public sector pay rises and higher welfare spending. The welfare bill alone jumped by £15 billion over the last year.

Public sector debt stood at £2,644 billion at the end of last month – equivalent to 96pc of GDP, a level last seen in the early 1960s. And over the last two months alone, the government spent no less than £12 billion on debt interest, much of which it funded by taking on yet more debt.

These disastrous figures make a mockery of the “£9.9 billion of fiscal headroom” that Chancellor Rachel Reeves last month claimed she will have in five years’ time. The new borrowing data is intensifying speculation Reeves will raise taxes further in the in her autumn Budget in a bid to balance the books.

But it strikes me that the UK economy is already stalling, not least due to the tax hikes she has already introduced – and that raising taxes even more is likely to generate a further slowdown, tipping Britain into a recession and making our public finances even weaker.

New survey data shows that the £25 billion increase in employers’ annual national insurance contributions (NICs), introduced from this month, alongside an inflation-busting 7pc rise in the minimum wage, has helped to push business costs up at the fastest pace for more than two years.

The S&P UK PMI composite output index - a long-established indicator based on extensive surveys of business leaders – fell to a 29-month low of 48.2 in April, down from 51.5 in March - with readings below 50 pointing to economic contraction.

This suggests that private sector output is now shrinking for the first time in a year and a half, with manufacturing lower for the sixth month in a row, staffing numbers down for seven consecutive months and service providers decreasing their business activity too.

The PMI survey noted that “April’s fall in output was the largest recorded for nearly two and a half years, consistent with GDP declining at a quarterly rate of 0.3% … with job cutting remaining aggressive as business optimism sank to a two and a half year low”.

Part of the reason for this slump is the rise in employer NICs - which, since its was announced last October, has cast a pall over hiring and broader business sentiment.

Plus, US President Donald Trump’s tariffs are already impacting Britain, along with many other countries – given the across-the-board 10pc duty on foreign goods sold in America, with higher levels on duties and exports of steel and cars.

On top of that, though, UK firms and households face the steepest energy costs in the developed world – in large part due to high taxation and heavy renewable energy subsidies that are added to our utility bills.

During the year to March, inflation was 2.6pc, down from 2.8pc the month before. This has led to widespread speculation that the Bank of England, having lowered interest rates from 5.25pc to 4.5pc since last summer, will not only cut interest rates again when the monetary policy committee next meets on 8th May, but will enact three or four more cuts by the end of this year.

I don’t buy that. For one thing, inflation will shoot up again when the figures for April are published, not least due to the 6.4pc rise in the energy price cap from the start of this month – taking the combined gas-electricity bill for the typical households to £1,849 per year. By this autumn, inflation will be well above 3pc, heading for 4pc – double the 2pc target – which will likely make it impossible for the MPC to implement multiple rate cuts.

This morning, Mike Graham asked me on to Talk Radio, to discuss Energy Secretary Ed Miliband’s latest plans – to introduce zonal energy pricing, which would split the country's single national power market into different regions and ultimately raise bills for southern England households.

As I discuss with Mike, high energy prices - not only for electricity and gas but also petrol and diesel – not only hurt UK households directly, but also indirectly as these fuels are key inputs in the production of almost all goods and services. In addition to pushing up inflation, high energy prices are hitting real GDP, wages and productivity.

Weighed down by a tax burden now at a 70-year high, and sky-high energy costs, the UK economy is in danger of stalling very badly. We are falling into a “doom loop” – in which weak growth threatens the public finances, causing ministers to reach for further growth-damaging and ideologically-driven tax hikes and subsidy-funding increases in energy bills.

Pretty soon, as growth fails to materialise, the Prime Minister will be looking for scapegoats. Ed Miliband is most certainly in the firing line.

Share this post