I chatted to

on Talk Radio yesterday about Trump’s tariffs – do have a listen to the interview above.We were talking at the end of a crazy week across global financial markets - and the wild swings we’ve seen in the value of stocks, bonds and currencies are likely to continue, keeping the world on edge during the coming week too.

The yield on ten-year US Treasury bills – a usually favoured financial “safe haven” – registered its sharpest weekly rise in more than two decades on Friday, with investors demanding ever more to lend to the US government, as this fully blown trade war between the world’s two largest economies escalates.

The price of gold, the ultimate refuge of spooked investors, then hit an all-time high – as Washington and Beijing engaged in an eye-watering tit-for-tat exchange, pushing the taxes on trade between the world’s two biggest economies into triple-digit territory.

None of this means that President Trump has “lost it”, as I discussed with Alex – despite the claims of increasing numbers of commentators on both sides of the Atlantic. There is method in Trump’s madness – as I suggested in a previous post.

The US President is basically right when he asserts that, for many years, global tariff patterns have been stacked against America, with both China and the European Union charging considerably higher levies on US goods sold in their domestic markets than vice-versa. There is logic – and considerable economic and political justification – behind his efforts to push for change.

Since “Liberation Day” on 2nd April, though, Trump’s deeply unconventional and extremely punchy attempts to shock other powerful economies into, in his words, “levelling the trade playing field” have caused financial markets to panic, forcing the White House if not into a U-turn then certainly a pause.

And even if Trump rides out the financial storm, and survives domestic and international political brickbats, his plans may anyway go badly awry.

That’s because the US President is trying to achieve nothing less than a recasting of the entire global trading system at America’s behest – as happened in the mid-1940s under Franklin D. Roosevelt and again during the mid-1980s under Ronald Reagan.

In both cases, the US was then indisputably the world’s most powerful economy, with the commercial and military supremacy and sufficient moral authority to impose on the world a trading regime not just made in Washington but designed to promote US commercial, political and strategic interests. These days, whoever is sitting in the White House, that may no longer be the case.

Trump has another big problem too. He’s only got four years to impose his vision – and much of America’s political and media establishment, as well as the leaders of traditional US allies, are determined he won’t succeed.

That reality won’t be lost on his adversaries in these upcoming trade negotiations, nations that don’t want the global pattern of tariffs and other trade barriers to change at all – as they benefit mightily from the status quo.

Last week’s spike in US Treasury yields raised eyebrows – and rightly so. It was the biggest selloff since the depths of lockdown in what is supposed to be the world’s safest financial asset class. The upward pressure on borrowing costs won’t be limited to America. Having said that, yields remain below where they were when Trump entered the White House in January, as shown in the graph below

US 10-year Treasury yield, year-to-date

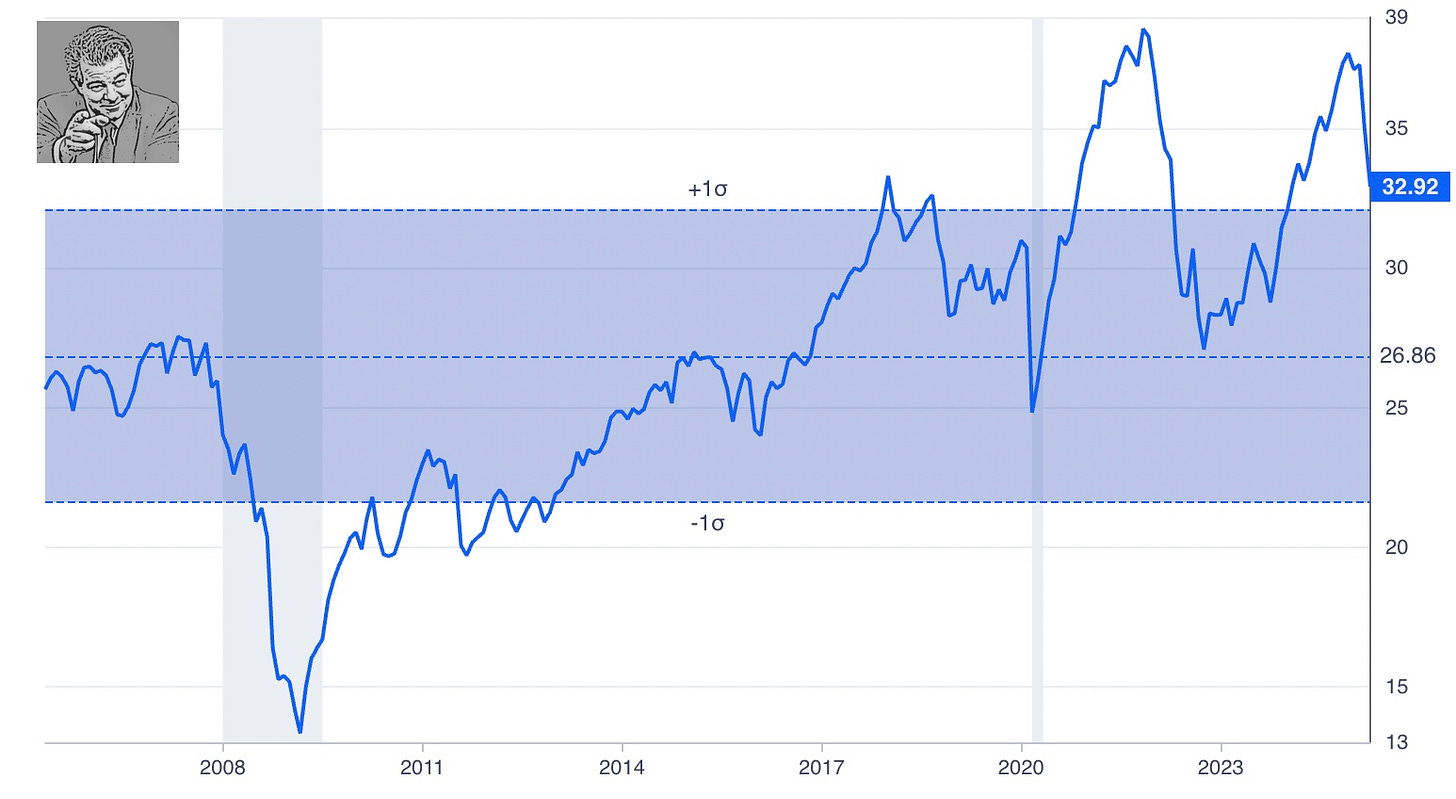

We’ve also seen steep falls in US equity markets since Trump’s tariffs announcements, of course, Again, though, stocks were enormously over-priced ahead of “Liberation Day”. The S&P 500 Shiller CAPE Ratio - a cyclically-adjusted price-earnings ratio that collectively values the stocks across America’s biggest equity index – was seriously elevated at 37.5 ahead of Trump’s tariff announcements, way above the its peak of 27.5 just before the 2008 financial crisis.

After recent gyrations, that same index remains just below 33 – still heavily over-valued in historic terms. It may be that US stocks were anyway, due a “correction” - and it was simply a question of what would trigger the fall. And even after all the “hair-on-fire” headlines of recent days, the S&P500, at the time of writing, is still almost 5pc higher than it was this time last year.

S&P 500 Shiller CAPE ratio (cyclically-adjusted price-earnings)

This is obviously an extremely serious situation – I am not underplaying that for one moment. The US and China together account for more than two-fifths of global GDP. If they were to engage in a prolonged all-out trade war that pushed them both into recession, that would seriously impact the entire world economy.

Having said that, amidst all the finger-pointing and posturing, both Washington and Beijing are very heavily incentivised to come to some kind of agreement – not least the Chinese, seeing as while the US sold goods worth $145 billion in China last year, the People’s Republic sold goods worth $440 billion in America, over three times as much.

What Trump needs badly to keep his tariffs reforms on the road is some political wins – proof that his plan can work, that other countries will indeed negotiate, that order will emerge from chaos, resulting in mutually beneficial trade deals.

So, as I told Alex, here’s a predication. Riding his luck, and despite America’s diminished power, Trump may well succeed in signing new bi-lateral trade deals with important trading partners over the next few months.

And the first could even be the UK.

Share this post